-

play_arrow

play_arrow

Radio Rehoboth

VIEWPOINT: Navigating cannabis, business law in the context of bankruptcy

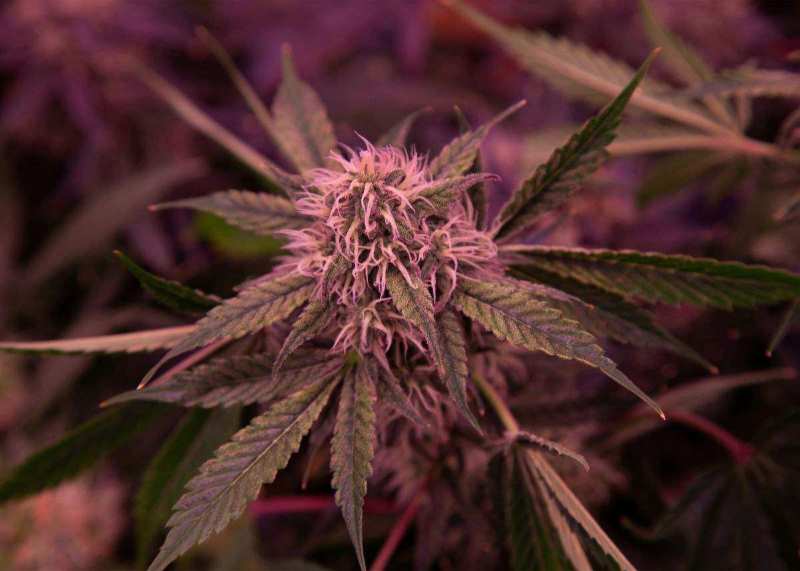

By addressing legal challenges and considering state law mechanisms, Delaware can foster a robust framework for cannabis businesses. | DBT PHOTO BY ERIC CROSSAN

The legal cannabis landscape has rapidly evolved, particularly in states like Delaware, which legalized medical marijuana in 2011 and recreational use in 2023. However, the complexities of cannabis law become more pronounced in the context of bankruptcy.

While legal in Delaware, cannabis remains classified as a Schedule I substance under the federal Controlled Substances Act. The federal prohibition creates a convoluted legal environment for cannabis businesses, especially concerning access to banking services and bankruptcy protections. Cannabis businesses in Delaware facing financial difficulties often encounter challenges, including lack of access to capital and banking services. While traditional businesses can file for protection under the federal Bankruptcy Code, cannabis businesses frequently find themselves ineligible for such protections. Courts have historically interpreted the Bankruptcy Code to exclude entities engaged in illegal activities, like cannabis operations, regardless of state legality.

Developments in Bankruptcy Case Law

Federal bankruptcy courts generally prohibit bankruptcy relief for operating cannabis businesses due to their violations of the CSA. This rule has been extended beyond companies directly involved in operating state-legal cannabis, to include equipment dealers and landlords who service the industry. See, e.g., In re Way to Grow, Inc. 610 B.R. 338, 341 (D. Colo. 2019); In re Rent-Rite Super Kegs W. Ltd., 484 B.R. 799, 809 (Bankr. D. Colo. 2012).

Yet, the legal framework in bankruptcy has started to evolve. While distressed cannabis operators remain ineligible for bankruptcy relief, bankruptcy courts have increasingly taken a case-by-case to eligibility for companies with indirect involvement in cannabis. As one court noted, “the mere presence of marijuana near a bankruptcy case does not automatically prohibit a debtor from bankruptcy relief.” In re Burton, 610 B.R. 633, 637 (B.A.P. 9th Cir. 2020). A bankruptcy court “must be explicit in articulating its legal and factual bases for dismissal in cases involving marijuana.” Id.

Following that admonition, in 2023 a Los Angeles bankruptcy court denied a motion to dismiss the bankruptcy petition of The Hacienda Company (“Hacienda”). Hacienda operated as a state-legal cannabis company until 2021 when it ceased manufacturing operations. Hacienda later filed for Chapter 11 bankruptcy protection seeking to sell its ownership interests in a Canadian entity to raise funds to pay creditors. In re The Hacienda Company LLC, 647 B.R. 748, 756 (Bankr. C.D. Cal. 2023). The court noted that there is no rule automatically requiring dismissal of a bankruptcy petition because the debtor violates any law. To the contrary, the court found that “Congress has shown a willingness to avoid punishing a debtor that may have violated law when ‘the real victims would be innocent creditors.’” The court refused to apply a bright-line rule.

More recently, a San Francisco bankruptcy court analyzed whether an individual chapter 7 case should be dismissed because its assets included ownership interests in LLCs operating state-legal dispensaries. In re Callaway, 663 B.R. 109 (Bankr. N.D. Cal. 2024). Following the example of Hacienda, the court eschewed a bright-line approach. The court found that the potential of a sale by the chapter 7 trustee of a passive ownership interest in a business did not, on its own, constitute cause to dismiss the case.

As the cannabis industry matures, there may increasingly be cases fitting within this framework. It is to be determined how Delaware bankruptcy courts will engage with these issues, but they may take guidance from developing case law in jurisdictions with more cannabis precedent, like California and Colorado.

State-Level Receiverships for Cannabis Businesses

In some states, receivership is an alternative to bankruptcy for struggling cannabis businesses. A receivership allows a court-appointed fiduciary to handle the debtor’s business affairs. This can be beneficial for cannabis companies requiring a formal process, but where bankruptcy is not an option.

Receivership has helped numerous California cannabis dispensaries and cultivators stabilize their operations and continue serving customers while addressing debts. Delaware does not have a receivership statute specifically tailored to cannabis businesses. But, like California, Delaware has general receivership laws that could be utilized.

Conclusion

The intersection of cannabis law and bankruptcy in Delaware presents a complex landscape. The federal prohibition on cannabis limits options. By addressing these legal challenges and considering state law mechanisms like receivership, Delaware can foster a robust framework for cannabis businesses, benefiting the state’s economy and its citizens.

Peter S. Murphy is a partner at Saul Ewing LLP and leads the firm’s Corporate Transparency Act (CTA) Team, located in Wilmington. Zev M. Shechtman is a partner in Saul Ewing LLP’s Bankruptcy & Restructuring Practice, located in Los Angeles. Zachary R. Kobrin is a partner in Saul Ewing LLP’s Cannabis Law Practice, located in Fort Lauderdale.

Go to Source:https://delawarebusinesstimes.com/news/viewpoint-navigating-cannabis-business-law-in-the-context-of-bankruptcy/

Author: Guest Writer

Written by: RSS

Similar posts

Chart

Top popular

News Briefs 10/17/23

Board of Commissioners Workshop & Special Meeting – November 6

Six Sussex road projects considered in latest CTP

Knicks vs. Cavaliers prediction, odds, line, spread, time: 2023 NBA picks, Nov. 1 best bets from proven model

NFL Week 17 highlights: Packers, 49ers, Saints, Steelers win, Cardinals stun Eagles

Copyright 2023 East Sussex Public Broadcasting, Inc.